Candlestick patterns are part of the technical analysis process traders use to evaluate investments. While complete analysis also includes fundamental and sentiment aspects, the technical part is the most important, as it’s based on data trading activity and price patterns.

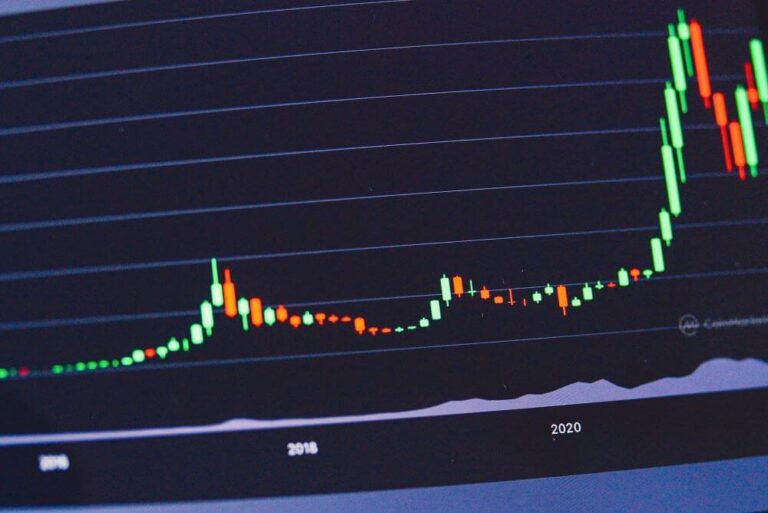

Usually, traders look into past prices to determine future performances and pinpoint safe entry points. Different time frames affect price movements because every individual has a different trading style. For example, intra-day traders open and close their positions on the same day, so they focus on time frames of about 5-minute charts. On the other hand, long-term traders might focus even on weekly charts.

These charts include candlestick patterns, whose forms and diversity help traders make more informed decisions. While there are generally 42 types of candlestick patterns, traders can break them down into simple and complex forms, so they must study their formation to understand how the chart works.

Let’s break down the candlestick formation process.

Candlestick body breakdown

The body of the candlestick offers essential information about an asset’s price. Usually, a longer body reflects more buying or selling pressure, while a short body shows price consolidation. When the candlestick elongates, the price moves from open to close, so buyers trigger a bullish motion.

However, if the candlestick is hollow, there’s more buying pressure, while a filled candlestick indicates selling pressure. That’s why a long black pattern shows how the prices decline and can even showcase the selling pressure turning into panic.

Two other important candlestick bodies are the Marubozu brothers, which lack bars or shadows in candlestick patterns. White Marubozu forms when the open, the low, the close, and the high balance, showing buying power. The Black Marubozu candlestick is the opposite, so the open corresponds to the high, and the close is balanced to the low.

Candlestick shadow meaning

The shadow is the upper and lower part of the candlestick, and it concerns the condition of trading sessions. Shadows can be:

- Short, showing how the trading occurred near the open and close;

- Long, so the prices went well past the open and close;

It is also possible for the candlestick to have a long upper shadow with a short lower one, meaning buyers bid their prices while sellers had to lower their expectations. The opposite happens when sellers trigger prices to reach lower levels, but buyers come by the end of the session and turn the cards in their favor.

An important form of a candlestick is the spinning top, where both shadows are long, while the body is tiny. These elements show indecision, as buyers’ and sellers’ activity made little change within the session.

Candlestick Doji type

The Doji candlestick appears as a cross, an inverted cross, or a plus sign in patterns. It can add meaning independently or be part of another candlestick. Doji occurs when the opening and closing are equal, but it can be a neutral pattern when alone.

It may not be such a good sign when a Doji appears in the chart, as it conveys indecision between the buyers and sellers, and no one seems to gain control over price movements. However, the significance of a Doji depends on the candlestick around it.

At the same time, there are more types of Doji traders must know about, such as:

- The Long-Legged Doji showcases how prices traded above and below the opening session but closed, so there isn’t much of a change;

- The Dragonfly Doji happens when the open, high, and close are the same, and the form has a long lower shade that shows sellers dominated trading, but buyers pushed prices back;

- The Gravestone Doji is similar but has a long upper shadow instead, and indicates buyer dominance at first and seller resurfacing at the end;

Candlestick positions

The way candlesticks move and stand near others is an important visual cue for traders. Therefore, with enough research and learning, they can differentiate when a candlestick reflects something individually or in a group.

That’s why the candlestick positioning is important, and it can be in the form of:

- A star, when it gaps away from the previous candlestick, which has a larger body, and the second, which tends to be smaller;

- Harami, so the candlestick is nestled inside the first with a larger body and the second having a smaller body;

The candlestick positioning matters because it represents the opening trend on the first day compared to the second day.

The most important candlestick patterns

With so many candlesticks, traders might have a hard time learning them and being able to seize them in charts. However, with a little bit of practice and technology, anyone can become a successful trader. Let’s start with bullish candlestick patterns, the ones suggesting buying pressure and overcoming the selling pressure:

- The Hammer pattern includes a small body candlestick with a long lower shadow following others, and it showcases a potential uptrend;

- The Piercing Line pattern has two candlesticks that reveal a bullish trend, as the first one is bearish and the second bullish;

- The Morning Star pattern involves three candlesticks. The one is long and bearish, the second is small, and the last one reveals an uptrend;

On the other hand, bearish candlestick patterns trigger a price decline as the selling pressure is overthrowing the buying pressure through:

- The Hanging Man pattern, with a candlestick with a small body at the tip and a lower shadow;

- The Dark cloud cover pattern has two candlesticks with bullish and bearish designs, suggesting a shift from buying pressure to selling;

- The Evening Star pattern includes three candlesticks. The first one is long and bullish, the second is small-bodies, and the last closes near the middle of the first;

Final considerations

Analyzing candlestick patterns is an essential part of the entire trading process, where the technical part blends with fundamental and sentiment breakdown. These elements help traders make better decisions based on their short—or long-term strategies, as candlesticks form based on previous prices. Hence, by following the market closely and watching candlestick patterns, traders gain information about different time frames for price movements.