In the fast-paced digital economy, businesses are constantly seeking ways to reduce operational costs while improving efficiency. One of the most effective strategies is the implementation of automated payment systems. These systems leverage advanced technologies, including artificial intelligence (AI) and machine learning, to streamline payment processes, minimize human intervention, and enhance security. For businesses operating a white label crypto exchange, automated payment systems provide a significant advantage by optimizing resources and cutting operational expenses.

The Role of Automated Payment Systems in Cost Reduction

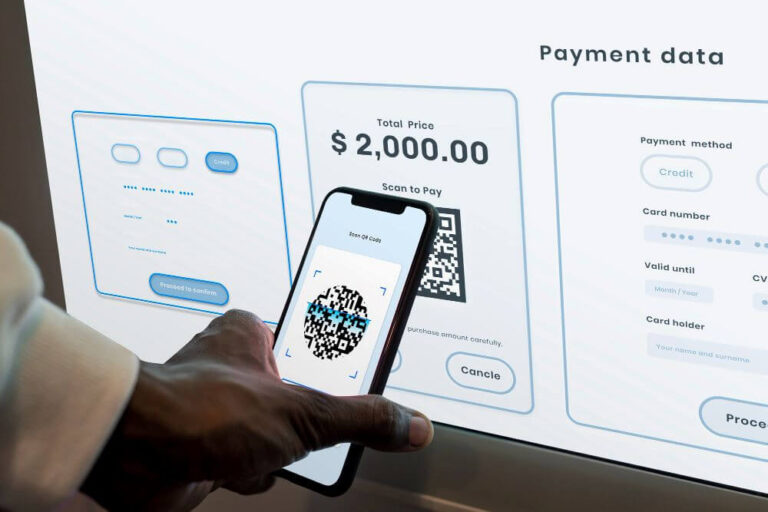

Automated payment systems are designed to handle financial transactions with minimal human involvement. These systems manage everything from payment processing and verification to fraud detection and reporting. By automating routine and repetitive tasks, businesses can significantly lower labor costs and reduce the risk of human error.

For a white label crypto exchange, where transaction volumes can be substantial, automated systems play a crucial role in ensuring fast and accurate payment processing. This reduces the need for manual oversight, allowing businesses to reallocate resources toward growth-oriented initiatives.

Minimizing Manual Labor and Administrative Costs

One of the most immediate benefits of automated payment systems is the reduction of manual labor. Traditional payment processes often require extensive human involvement for data entry, reconciliation, and verification. This not only increases labor costs but also leaves room for human error, which can be costly to rectify.

By implementing automated payment systems, businesses can reduce the number of staff required for these tasks. For instance, a white label crypto exchange can automatically verify user transactions, manage payment settlements, and generate financial reports. This reduces the administrative burden and allows employees to focus on more strategic activities, leading to improved operational efficiency.

Enhancing Accuracy and Reducing Errors

Errors in payment processing can lead to financial losses, customer dissatisfaction, and regulatory non-compliance. Manual payment systems are particularly susceptible to inaccuracies, especially when handling large transaction volumes.

Automated payment systems leverage advanced algorithms and machine learning to ensure accurate transaction handling. For businesses running a white label crypto exchange, this means fewer discrepancies and faster resolution of payment issues. Automated checks and balances minimize the likelihood of errors, reducing the costs associated with correcting mistakes and maintaining compliance with industry regulations.

Lowering Transaction Processing Costs

Automated payment systems can also lower transaction processing costs by reducing the need for intermediaries and manual checks. For example, traditional payment methods may require banks or third-party services to verify and process transactions, resulting in additional fees.

In contrast, automated payment solutions can facilitate direct and instantaneous transactions, cutting down on intermediary costs. This is particularly beneficial for a white label crypto exchange, where rapid and cost-effective payment processing is essential to remain competitive.

Improving Cash Flow Management

Efficient cash flow management is critical for business sustainability and growth. Automated payment systems provide real-time transaction tracking and reporting, enabling businesses to monitor and optimize cash flow more effectively.

For a white label crypto exchange, automated systems can instantly process incoming and outgoing transactions, ensuring timely access to funds. This not only reduces cash flow bottlenecks but also improves liquidity management, allowing businesses to allocate capital more effectively and reduce financing costs.

Reducing Compliance Costs

Regulatory compliance is a significant concern for businesses handling financial transactions. Manual compliance processes can be time-consuming and prone to errors, leading to costly fines and penalties.

Automated payment systems are programmed to adhere to regulatory standards and can perform compliance checks in real time. For businesses operating a white label crypto exchange, this means maintaining compliance with financial regulations without the need for extensive manual oversight. Automated reporting also simplifies audit processes, reducing the time and cost associated with regulatory reviews.

Future-Proofing Operations with Automation

As the digital economy continues to evolve, the demand for faster, more secure, and cost-effective payment solutions will only increase. Implementing automated payment systems allows businesses to scale operations without a corresponding increase in costs.

For a white label crypto exchange, future-proofing operations with automation means staying ahead of technological advancements and market demands. Automated systems can be easily updated and integrated with emerging technologies, ensuring long-term cost savings and operational efficiency.

Conclusion

Reducing operational costs through automated payment systems is a strategic move for businesses seeking to enhance efficiency and competitiveness. For a white label crypto exchange, these systems offer significant benefits, including minimizing manual labor, improving accuracy, lowering transaction costs, and ensuring compliance. As automation technology continues to advance, businesses that adopt these solutions will be well-positioned to optimize operations and achieve sustainable growth.